Without large distribution, The Reunion agrifood industry would never have developed as it did, As well as food and non -food trade. Too, After four years of upsetting markets, Get out directions to evolve, in line with each other, becomes of capital importance for all. This is the ambition of the fourth congress of trade in Reunion. Stratco Run 2025 invites you to take advantage of twenty years of experience in the consumption sector that Emily Mayer has this year, Director of studies at Circana. Circana is a leader in the analysis of consumption trends. Thanks to advanced technology based on artificial intelligence and on predictive data analysis, Circle permit to ses clients - retailers, consumer products - to understand consumer behavior, market and demand. Emily Mayer's conference will wear long time, on the structuring elements which, Nowadays, make it possible to identify major consumption trends and growth opportunities associated with them. Point that it seems relevant to underline : at the Stratco Run rostrum preceded Yves Puget, editor -in -chief of LSA magazine (In addition animator of Congress) in 2022, Philippe Goetzmann, Retail and food consultant, In 2023 et Xavier Terlet, food innovation expert, in 2024. That is, stakeholders in years of crisis, erecting inventory, explaining the facts, evoking solutions but of an uncertain future. The fact that Emily Mayer intervenes when a certain economic recovery seems to be looming on the horizon will give its light on commercial and industrial strategies another perspective.

Meeting Leader : You have just gave a conference at Stratco Run in September. What motivated you to come and share your expertise on our island and what this trip represents you, Personally and professional ?

Émily Mayer : What motivated me, It is first of all the Stratco Run team, very convincing to highlight the interest of the event. I found this proposal very nice. Interventions, I do a lot, But very little outside of metropolitan France. I knew the meeting twenty years ago during a personal trip. I stayed there a fortnight. I understood that the island had evolved a lot, especially in recent years. I am curious to rediscover the meeting with these developments. From a professional point of view, I am also curious to discover local trade. Twenty years ago, I had absolutely not approached the island through this prism. Previous stakeholders in the Stratco Run congress have made stores for me, Hypermarkets in particular, A fairly attractive description, and different from what we see in mainland France.

International company, Circana is a benchmark for the entire large distribution sector and its suppliers. What makes the power of analysis and distinguishes Circana in the middle of the abundant market of market studies ?

What distinguishes us, This is the coverage of our data. We cover the consumption sector as a whole. We have many solutions for this : The Large Distribution Panel, Panels on the toy sectors, you sports, beauty. We also cover out -of -home catering. Our transaction panel provides an overview of the French expenses. This is what makes our strength : We are not specialized in a sector and, At a time when consumption is fragmented, It is increasingly important to be able to have a general view, especially on the overtime, for example between what is happening in a brand of mass distribution, in restoration or at a specialist like large costs or biocoop. We also have the power of technology to process and analyze these large amounts of data. To achieve a presentation that is simple, friendly, operational, of all this data, You have to have technology behind, and more and more artificial intelligence. It’s this coupling of the two, data and the tool to treat data, WHO CHARACTURISE SERCANANGE.

What types of data do you collect and treat yourself ?

We process bank transaction data, points of sale data, Consumer data. We also collect shoppers in stores. We ask people, especially in large distribution. We also have geomarketing tools to cut the territory and thus better understand local consumption. We can quantify, cross, analyze a lot.

That the approach of insights brings, consumer, as decision -making aid of brands and distributors ?

A distributor or a brand have many different data sources. Our work, Chez Circana, It is to structure this data, to pre-analyze them. These are the insights. With artificial intelligence, We are able to put in the hands of the actors in the consumption sector of preformated relationships which will help them very quickly understand their situation. The goal of insights is to get a clear vision : Where is the market, Where is my brand, Where are my products ? What will explain that I am in this position, or growth, either decrease, either stability ? It is a question of understanding and then making the right decisions. Chez Circana, We have the data, We have the tools. Ensuite, The intelligence of our teams arises on this material to shed light on all the actors.

Dominique Schelcher, CEO of cooperative u, declared recently to see positive signs in the revival of consumption during Easter week. He was based on Circana results ?

Yes, We work with cooperative u, as with all brands. Our data, nos insights, irrigate all the players in the distribution, Brands sold in supermarkets, as well as all professional federations, Trade and media trading bodies.

Circana publishes weekly insights : What lessons do you learn from a period as short as a week ?

The weekly data is a thermometer, It is used to measure the temperature of consumption at a given time, To understand the impact of a particular factor. for example, A distributor has produced an important catalog : He wants to know if the operation worked or not. Or it was a competitor who has undertaken a big action : The distributor needs to know if it affected it. An industrialist is launching an advertising campaign, He wants to know what is the impact. The weekly insight being the equivalent of a thermometer, The temperature it measures must be supplemented by analyzes on longer times - monthly, half -yearly, annual, even over a full decade - to generate a meaning. Historical analyzes make it possible to put into perspective, to exceed, What the weekly thermometer could bring out, generate, concern. We generally realize that the event that aroused so much emotion was actually anecdotal. It was enough to wait for the following week to calm down.

How do we go from the encrypted analysis to understanding consumer behavior ?

In the large distribution sector, The figures come from the data from the boxes of boxes. Behind these figures that we analyze, There are the purchases of the French : You should never lose sight of it, and always analyze data with this reality in mind. This is what allows you to do the right analyzes and give them meaning. The purpose of our profession, It is to give meaning to the data, by bringing it closer to the behavior of buyers.

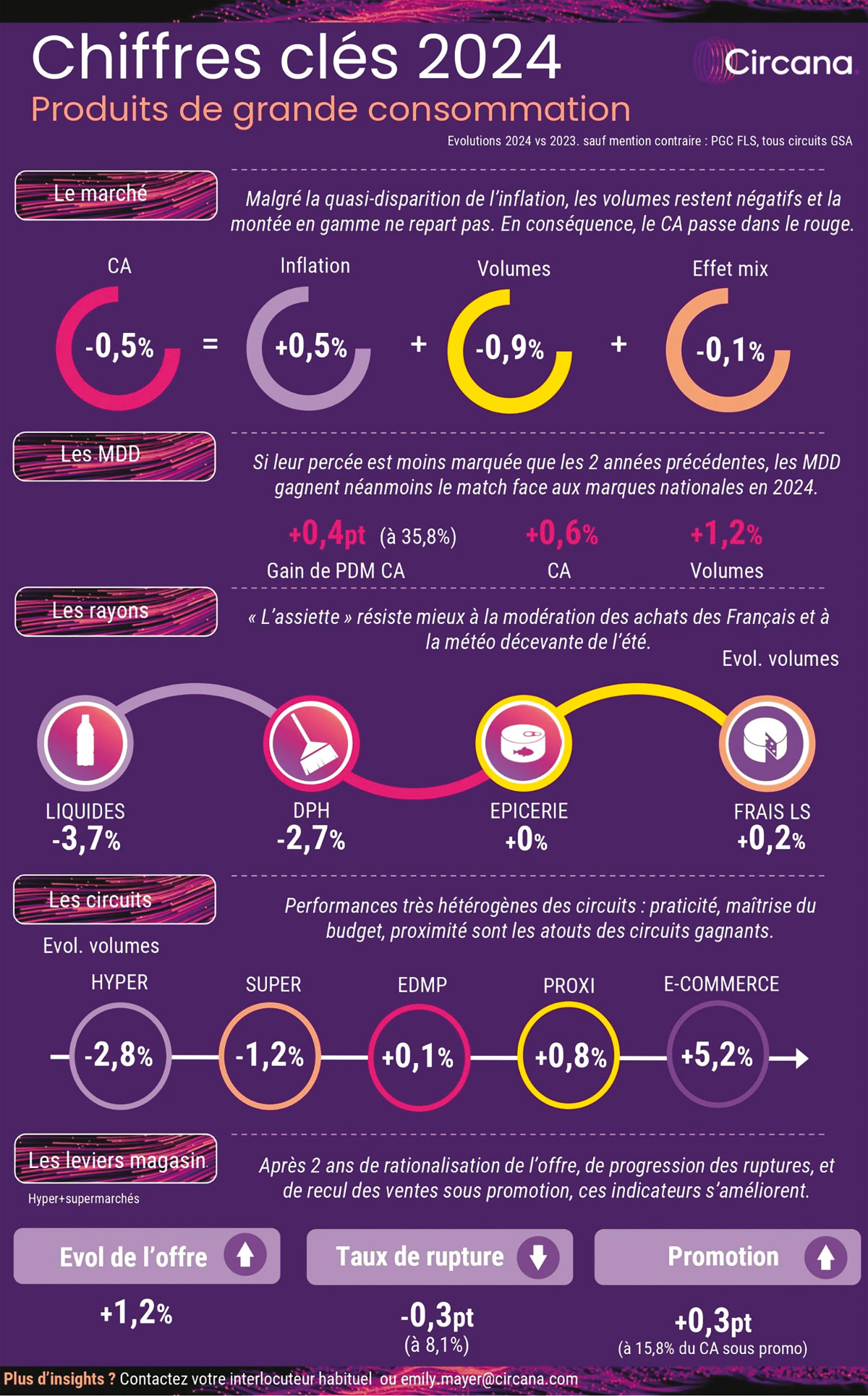

The latest data you have confirm- they a thrill of consumption in mainland France ?

Yes. The data recorded until the end of April show that the volumes leave slightly upwards. Consumer products earn 1 % in volume in mainland France. This may seem weak, But you have to remember that since 2021, So also in 2022, 2023 et 2024, consumption volumes were down. This thrill is therefore rather positive : The French put a little more products in their basket. The other positive element, It is that we observe a form of reinvestment in everyday products, with a small upmarket where, During the years of inflation, The French were "downmarket". They bought less organic products for example, fewer national brands, More distributor brands, More first prices. This trend is reinforced. The organic is less badly, Local brands are growing. You shouldn't get carried away, But small positive clues are observed during the first four months of the year. It is rather encouraging.

Insights show contrasting developments according to the categories. Are there products, food and non -food, currently in the wind in the stern ?

Non-food, in general, does not go well in large distribution. On the consumer products side, There are indeed categories of rapidly growing products, which represent opportunities for manufacturers. Protein products, For example, work well, Energy drinks, High -protein bars, Skyr in the yogurt department, card. We feel that the relationship to the body, health, French has evolved. They are more ready than they were in the past consuming foods that will have an impact on - I put quotes - their "performance". World products also work well. We feel an opening on the world, his tastes, A desire to vary the pleasures on a daily basis with spices, Different sauces, etc. And then there is the pleasure of pleasure in food. Pleasure products sell extremely well. Everything that revolves around chocolate, All products for aperitif. Everything that is going to spread, sausage, Chips, also works very well.

Below : Promotions remain a purchase engine.

Do you see growth opportunities for manufacturers in this period of uncertainty ?

Beyond the products I have just mentioned, There are opportunities for distribution circuits. Large distribution has several formats. On the last decade level, We note that the drive and proximity are the circuits that are best. It’s still very true in the short term. Drive and local shops appear as fairly solid growth relays. Classic supermarkets are less well, especially hypers. After, There are opportunities related to more structuring factors, like demographic developments. In a city, We observe a very clear aging of the population. However, this target of seniors is still little worked by consumer products. You have to think that a third of the population will be more than 60 years old in a few years : Another field of innovation opens, and an interesting potential for all the actors. I will summarize by saying that there are opportunities on products, on targets and on distribution circuits.

Marketing highlights the importance of "last meter before purchase" in consumption behavior. Is it also your opinion ?

If you mean the point of sale by that, indeed, He is decisive for a lot of things. For the purchase of a promotion : Most promotions are discovered in the point of sale. For innovation : here again, The first vector of discovery of a new product, This is the point of sale. These last years, We talked a lot about prices, But the experience in store is just as important. The store sends me an image of myself. It must be well kept, that it is not impoverishment, that I appreciate navigating inside. Eventually, les shoppers, People who do the shopping, have fairly simple expectations. They want rays that are well filled, well -organized. They don't need PLV in all directions, devices requiring a lot of investment, But points of sale in which they see clear, well -marked, where they do not need to look for the products for hours. As the consumer markets lack dynamism, le category management, le merchandising, become important tools again, Because that’s there, in the point of sale, that the difference will be done.

If you mean the point of sale by that, indeed, He is decisive for a lot of things. For the purchase of a promotion : Most promotions are discovered in the point of sale. For innovation : here again, The first vector of discovery of a new product, This is the point of sale. These last years, We talked a lot about prices, But the experience in store is just as important. The store sends me an image of myself. It must be well kept, that it is not impoverishment, that I appreciate navigating inside. Eventually, les shoppers, People who do the shopping, have fairly simple expectations. They want rays that are well filled, well -organized. They don't need PLV in all directions, devices requiring a lot of investment, But points of sale in which they see clear, well -marked, where they do not need to look for the products for hours. As the consumer markets lack dynamism, le category management, le merchandising, become important tools again, Because that’s there, in the point of sale, that the difference will be done.

The experience lived in store must return a rewarding image of oneself : it is as important as the price. Below : After difficult years, The organic is finding some colors

Do we know what is the image of large distribution in French opinion ?

Consumers have a form of distrust of the system of large distribution and large multinational groups. The scandals that have occurred on certain products maintain this distrust. Let's go back a little back : Why did the Yuka application met with such success from its creation in 2017 ? Because it put in the hands of consumers a tool which was linked or to the signs, nor to brands. An independent tool that allowed them to make an opinion. The success of this app illustrates the desire to learn by yourself, Without listening to the messages addressed to us. Nevertheless, Large distribution is and remains a pillar of the daily life of the French, of all French. Almost 100 % of French people cross, at least once a year, The step of a store or a driver of large retailers. The latter represents more than half of the French food expenses.

Disappearance of Casino, Auchan difficulties, crossroads, etc. : Is it the hypermarket model that is in question, or the offer offered, or the downward price battle between brands ?

I would not talk about hyper in general as being in crisis. Talking about hypermarkets in a global way does not make sense in my opinion. Take E.Leclerc, the undeniable winner of all in recent years : son format principal, It's the hypermarket. There are extremely different realities within hypers. The dichotomy between self -employed and integrated seems more relevant to me. The independents, undeniably, have volumes that progress, which is not necessarily the case elsewhere. What differentiates them, This is a price advantage, Because the price remains fairly strongly correlated with performance, But it's not just that. We have just talked about the experience in point of sale : There are very pleasant points of sale, who have invested in the customer experience. I am thinking in particular of certain E.Leclerc stores, which are quite remarkable on this plan. Another asset of the self -employed, It is that there is a davandings of local assortments, because they have more freedom to make decisions locally.

In the meeting, Stratco Run 2024 made the observation that, After the inflation peak, The cheapest quest had become less systematic in the consumer, But that the time remained nevertheless to arbitrations, Frustration sources. Is this also the case in mainland France ?

This is what I said earlier about the relaxation observed on consumption. An index of this relaxation : the gap between distributor brands and national brands are tightening. At the height of inflation, mid-2023, distributor brands experienced a higher increase of 9 points to that of national brands. Today, Things rebalance. In these 1920s2-2023, Price increased by 20 % ! And 20 % on average : The prices of certain products jumped by more than 40 % ! It was completely new. The last peak in inflation that we had known, in 2008, had been 5 %. Large distribution had never experienced such a situation. The whole price repository was turned upside down. In 2024, Inflation has disappeared, Yet consumption volumes have not left. I think it took the time for people to integrate the new price standards. This is done gradually, We find a little more flexibility in purchases. Especially since wages are progressing a little faster now than inflation.

Do Circana studies allow them to see the place of local products in consumer purchases in regions ?

Yes, We manage to measure it. The local product is not easy to define : There is no specifications unanimously accepted by all. Chez Circana, We have created our own definition of the local brand so that we can then measure it. We consider that a brand is local from the moment it makes more than 50 % of its sales in a single region and that it is from this region. What we observe, It is that local products do not weigh much on the national average : 2,2 % of the turnover of consumer products. In shopper surveys, the Local, le made in France, is the favorite quality attribute of the French : One in two French people declares that they want to see more local products in large distribution stores. And yet these products do not weigh much in sales. I see an increase in large distribution. You have to see, however, that 2,2 % is an average. Champions of local products in mainland France are the Alsatians, with 9 % of the turnover of consumer products. Ensuite, we find the Bretons, Basques, Savoyards and northern people. It is- to say the regions which are on the outskirts of the metropolis, where local identities are quite strong. Regions also where a well -organized SME fabric was able to develop.

Large distribution is confronted in the overseas departments with the challenges of additional costs caused by importing from the metropolis of a large part of the products consumed. Is the solution against what is called expensive life in the increase on the part of MDD in the offer and in the discount ?

I am not a specialist in this subject, the metropolitan situation being completely different. I can only say that I am not convinced that the private label is a solution against expensive life. MDD sold locally will be always more expensive than the MDD sold in mainland France due to transport. If it can be part of the answer, She doesn't seem to me at the topic of the subject. I know there are quite important topographic constraints on Reunion Island, But is it not possible to produce and transform a little more products to meet the needs of the inhabitants ? Or to review the origin of imports, to bring them a little less far ? Sea granting also significantly increases the cost of products. To what extent is it possible to act on these factors : taxes, Provenance of products, Transformation and production on site ? And there are not inspiring examples to seek in other islands organized differently ?

What are today, according to you, consumer priorities to take into account by an industrialist or a distributor ?

Accessibility price remains essential : Two thirds of French people still say they pay attention to what they follow consecutively to the price increases in recent years. Even if it's going a little better, Financial constraint remains important. Health is another subject that matters a lot for the French. The relationship between food and health has become very close since the 2010s. You also have to be very transparent about what we offer. More generally, I think what the French expect, It is a real adaptation of the offer to their needs. When I do my shopping, I want to find products that match my consumption, And we do not consume the same way in downtown Bordeaux and in the Creuse. We must succeed in adapting the offer to needs, to make the model of mass distribution less general and more specific, to take into account consumer priorities. On the other hand, manufacturers and distributors have homework. This is my conviction. I consider that large retailers and brands must meet the environmental challenge. They are able to act on subjects such as packaging, Like the food mix, plant, etc. Car, In fact, What is consumption today ? Half, What people want, the other half, What we put in their nose ! If they only have products with packaging not very good for the planet and with meat, They will simply continue to buy and eat them. They will have no other choice. Economic actors therefore have the power to change consumption, to make it evolve towards more responsibility.

What will be the theme of your conference at Stratco Run ?

The idea will be to take a step back on what has happened in recent years, Because we have all been in laundry for four years with all these crises ! If everything is not rosy, The complaint of inflation still offers, We see it in the figures, a breathing. I will therefore focus on an analysis, not short -term, But large factors that today structure consumption over long time. These issues require transformations, But these are also real opportunities for commerce and consumption players.