The covid crisis has not affected the dynamism of cans in France. From 2019 to 2021, they continued to gain ground over other beverage packaging in stores according to data collected by the GIE La Boîte Boisson, member of Metal Packaging Europe and which represents the can industry in France.

In two years, can sales jumped 9,5% by volume, beyond the growth of the beer and soft drinks market (+ 6,5 %). Last year, 22,3% of drinks were sold in cans, i.e. an increase in market share of 0,5 point since 2019. Over a year, between 2020 and 2021, beverage boxes have even progressed faster (+ 4,1 %) than plastic bottles (+ 0,5 %) and glass (+ 3,3 %) despite the reopening of bars, cafés, restaurants… and the resumption of consumption on site. From the mini 15 cl can to the maxi 50 cl, all formats are in progress, with a sales boom of 20,5% for 25 cl.

The advantages of the can

The advantages of the can

Unbreakable, light, the cans are also made in France in eight out of ten cases… Infinitely recyclable, they are part of consumers’ desire to act for the environment. At the heart of new trends, they also respond to their desire for new things and inspire innovative companies. So, in 2021, nine out of ten Hard Seltzers, sparkling drinks that are all the rage among young adults, were launched in cans. Drink cans also shake up the codes of traditional markets : the year was notably marked by the arrival of multiple wine offerings, specialty beers or canned water.

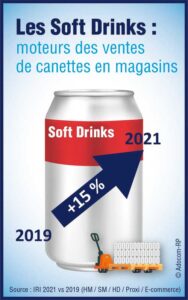

Les softs drinks, driver of can sales in stores

Les softs drinks, driver of can sales in stores

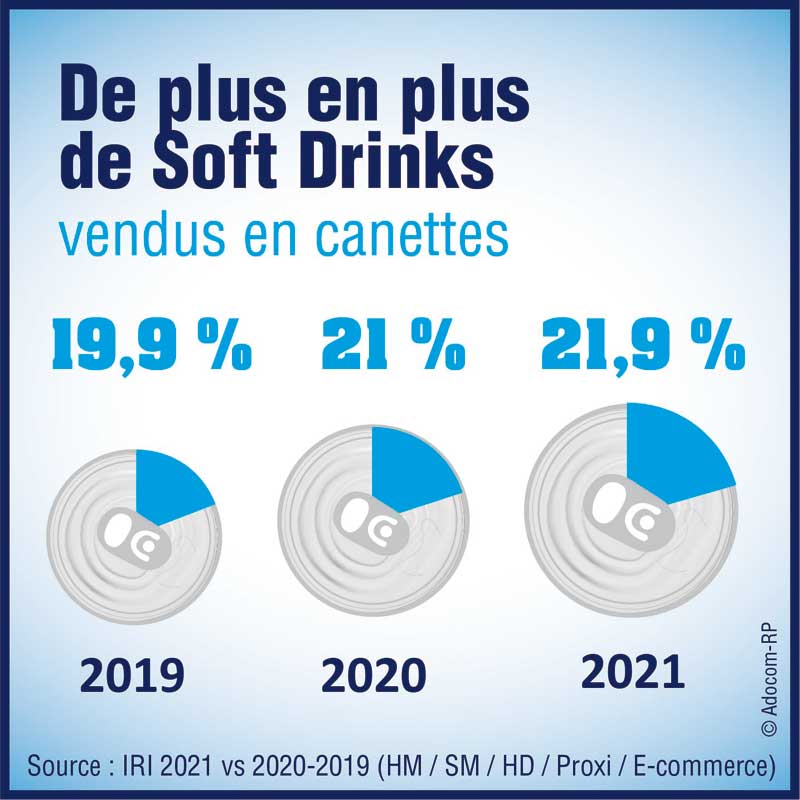

The increase in can sales is driven by the success of soft drink cans, which continue to gain market share from other beverage packaging. In two years, between 2019 and 2021, their sales increased by 15% in volume. If we focus on 2021, can sales increased by 7,3% in volume compared to 2020 : almost three times more than the market (+ 2,6 %). All segments are affected by the increase. In two years, the share of cans in sales of soft drinks in stores has gained two points, of 19,9% in 2019 to 21,9% in volume today : a historical part.

More than two out of ten beers sold in cans

More than two out of ten beers sold in cans

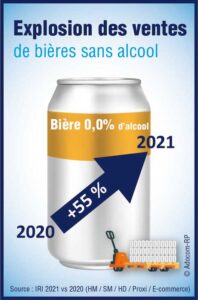

In 2021, the French bought 23% of their beers in cans for home consumption. A market share down slightly from 0,3 points compared to 2020 due to the fall in consumption of so-called “luxury” beers, in which the can is strongly present and whose sales of all packaging have decreased by 11,9% in volume over one year. On the other hand, beer can sales explode on non-alcoholic beers, with +55% sales in volume between 2020 and 2021, and continue their progress on specialty beers (abbey beers, flavored beers, etc.) : + 5,4% in volume between 2020 and 2021 and + 7% between 2019 and 2021.

Canned water : a trend that is confirmed

Canned water : a trend that is confirmed

Sales of canned water are accelerating in 2021 thanks to the numerous brand innovations and product launches that have flooded the shelves this year. Sales of canned flavored water thus recorded an increase of 6% in volume., in a global market at +2%. Canned sparkling waters saw a 9% jump in volume, in a global market – 6 %.

Success in mass distribution and convenience stores

Success in mass distribution and convenience stores

If can sales record their strongest growth on online sales sites (+ 11 %), it is on traditional circuits that they drive the drinks market. Their sales thus increased by 6,6% in local stores (vs + 4,5% for the market). In hypermarkets, they progressed by 5,9 % (vs + 2,9% for the entire market).Finally, sales of drink cans have also grown faster than the market in supermarkets : + 5,5 % (vs + 2,3 %).

Energy drinks and fruit drinks : the can boom

Energy drinks and fruit drinks : the can boom

On the soft drinks market, if can sales are booming in all segments, Last year, they recorded particularly marked increases in energy drinks and still fruit drinks. (BAFP), with double-digit growth. In 2021, sales of energy drinks in cans jumped 25% in volume compared to 2020 (all packaging : + 24,8 %). Fruit drinks sold in cans are also seeing spectacular growth at +16,7 % (all packaging : + 6,1 %).